Directors and officers of corporations owe their shareholders and corporations a fiduciary duty. But what exactly does this mean?

Find out more about getting legal help

by Brette Sember, J.D.

Brette is a former attorney and has been a writer and editor for more than 25 years. She is the author of more than 4.

Updated on: September 3, 2024 · 8 min read

Fiduciary duty in a business context refers to acting in the best interests of your shareholders and stakeholders.

Taking the time to understand what fiduciary duty is will help you protect both yourself and your company. Our guide uncovers the types of fiduciary duties, how fiduciary duty relationships work, and what happens when you face a breach of fiduciary.

Fiduciary duty essentially means that you are responsible for acting and doing things to benefit someone else. The person with a fiduciary duty is known as the fiduciary, and the person or persons they are responsible to are referred to as the principal or the beneficiary.

In a corporation, the board of directors and the officers have a fiduciary duty to the shareholders and the corporation itself. If you are part of a partnership, you and your partners have fiduciary duties to each other.

When you form your business, it's important to understand your responsibilities and to whom you owe them.

Laws surrounding fiduciary duty requirements can differ depending on the state and the type of fiduciary relationship. However, the general types of fiduciary duties are as follows.

A fiduciary relationship is when one party (the beneficiary) places trust and confidence in another party (the fiduciary) to act in their best interest and help them make important decisions—typically in business, finance, or managing assets.

Contracts, wills, trusts, and corporate settings can bind fiduciary relationships. For example, a board of directors has a fiduciary duty to act in the best interest of each other and the company's shareholders. Whereas a doctor has a fiduciary duty to always act in the best interest of their patients.

There are many different types of fiduciary relationships, but the general fiduciary duties always remain the same, no matter the scenario. That is, the fiduciary is responsible for upholding a duty of care, loyalty, and good faith.

Below are some common examples of fiduciary relationships.

For a healthy fiduciary relationship to work, trust must exist between the two parties. As a fiduciary, you have a responsibility to act in the beneficiary's best interest and ensure that trust is maintained. In some cases, you may represent another person as a fiduciary, like a lawyer to a client. In other cases, your responsibilities come with the role, like how directors on a company's board are responsible to each other and their stakeholders.

To maintain a healthy fiduciary relationship, you must always:

A breach of fiduciary duty happens when a fiduciary fails to uphold their duties and responsibilities and doesn't act in the beneficiary's best interest. For example, if a board member leaked information about an upcoming deal to a friend and the deal fell through because of it, this would be a breach. The corporation can recover damages for any breach by a fiduciary through a lawsuit.

Some examples of breach of fiduciary duty examples include:

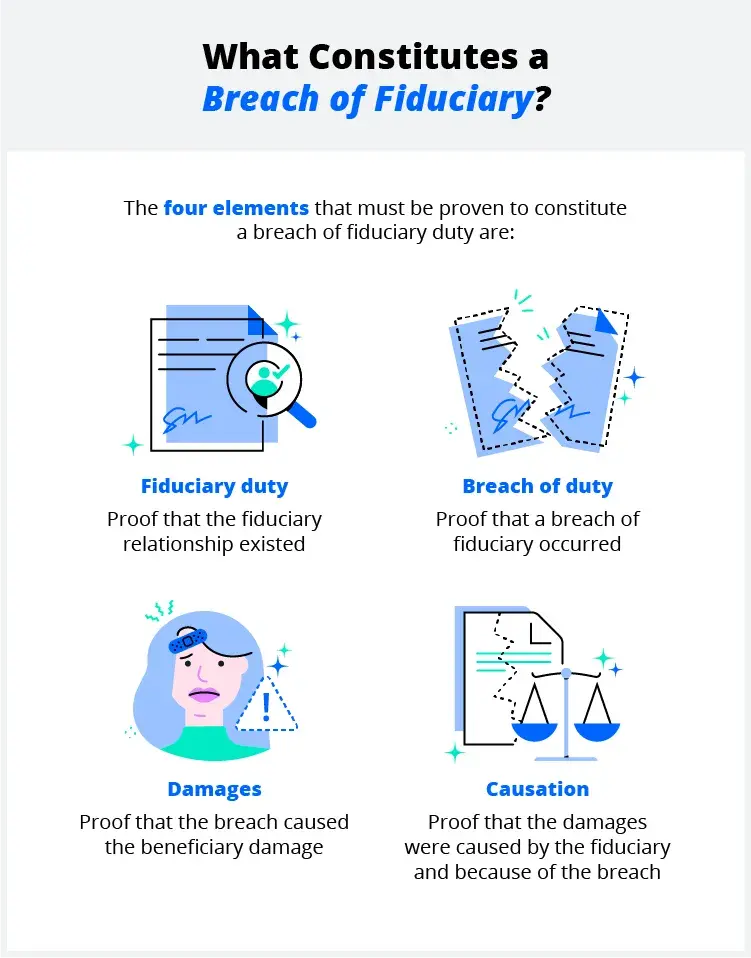

There are four elements that must be proven in order to constitute a breach of fiduciary duty, including:

If all four elements of a breach of fiduciary duty are proven, the fiduciary involved can face many consequences—both in a legal and professional sense. Possible consequences include monetary penalties for any damages and even the removal or suspension of a fiduciary.

Here are a few consequences you can face if you are involved in a breach of fiduciary duty:

If someone has accused you of a breach of your fiduciary duties, it's important to act quickly. Get a lawyer or attorney to support you so you can keep yourself protected and avoid a breach from occurring. A fiduciary breach accusation is a huge deal, but a legal team can help you build a case to defend yourself properly.

Tip: In a corporate setting, have your corporate policies clearly outlined so all employees know the duties they must uphold in their roles. This can help decrease the chances of a fiduciary breach occurring.

Any person who has an obligation to act in the best interest of another person or persons is considered a fiduciary. A fiduciary can be a lawyer representing a client, a trustee and a beneficiary, a corporate board and shareholders, and even employees and a company. In most cases, a fiduciary is legally responsible for helping their beneficiary make important decisions related to business, finances, and managing assets.

There are many different fiduciary duties that an individual must uphold, including the duty of loyalty, good faith, care, confidentiality, prudence, and the duty to disclose. However, a fiduciary's overarching and most important duty is to always act in the beneficiary's best interest. Acting in your own best interest for personal gain can lead to a conflict of interest and a potential breach of fiduciary.

In real estate, a fiduciary relationship can exist between an agent (fiduciary) and the buyer or seller (beneficiary). So the agent has an obligation to act in the best interest of the buyer or seller. They must disclose all relevant information regarding the transaction and act with the utmost care and loyalty to the client.

In the duty of care, you have an obligation to do your due diligence. Be sure to research and inform the beneficiary of all information that could help them make sound decisions.

Example: If you are a director, before you vote on anything before the board, it's your responsibility to research the matter that's up for a vote and become informed before you cast your vote. Being informed doesn't mean just passively accepting the information at hand, though. It requires critical thinking and independent consideration.

With the duty of loyalty, you must always act in the beneficiary's best interest and not for your own gain. Avoid any situation that could act as a potential conflict of interest.

Example: If you are the president of a corporation, it would be a violation of the duty of loyalty to push for a contract to be awarded to your spouse because, in doing so, you're acting in your personal interest and not in the best interests of the shareholders.

Fiduciary duty is a critical component of an officer's, director's, or partner's responsibilities in their role at the company. Fiduciary duties are there to protect the company and its shareholders. Understanding and upholding fiduciary duties will give you peace of mind and ensure your company benefits.

Find out more about Getting Legal HelpThis article is for informational purposes. This content is not legal advice, it is the expression of the author and has not been evaluated by LegalZoom for accuracy or changes in the law.

You may also like

A healthy fiduciary relationship requires trust. It's important to understand the situations in which fiduciary duties arise and what they require.

November 1, 2023 · 3min read

Considering an LLC for your business? The application process isn't complicated, but to apply for an LLC, you'll have to do some homework first.

July 29, 2024 · 11min read

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

July 29, 2024 · 22min read